Can I Send Money From Cash App to PayPal? The Definitive Guide

Navigating the world of digital payments can be tricky, especially when you’re trying to move money between different platforms. One common question that arises is: “Can I send money from Cash App to PayPal?” The short answer is, directly, no. However, there are workarounds and alternative methods to achieve this. This comprehensive guide will walk you through these methods, explaining why a direct transfer isn’t possible, exploring the intricacies of each platform, and providing you with step-by-step instructions and expert advice to get your money where it needs to go. We aim to provide a trustworthy, authoritative, and genuinely helpful resource for anyone seeking to bridge the gap between Cash App and PayPal.

Understanding the Limitations: Why No Direct Transfer?

Both Cash App and PayPal are popular digital payment platforms, but they operate as independent ecosystems. A direct transfer between them isn’t possible due to several reasons:

* **Technical Infrastructure:** Each platform utilizes its own proprietary technology and security protocols. These systems aren’t designed to communicate directly with each other.

* **Security Concerns:** Direct transfers could create security vulnerabilities, as each platform has different security measures in place. Bypassing these measures could expose users to fraud.

* **Competitive Landscape:** Cash App and PayPal are competitors. Enabling direct transfers could reduce user engagement within each platform, as users might be less inclined to keep funds stored on one platform if they can easily transfer them elsewhere.

* **Regulatory Compliance:** Financial regulations often require payment platforms to maintain strict control over fund transfers, which can be difficult to ensure with direct inter-platform transfers.

Workaround 1: Using a Bank Account as an Intermediary

The most common and reliable method to transfer money from Cash App to PayPal involves using a bank account as an intermediary. Here’s how it works:

- **Add Your Bank Account to Cash App:**

- Open the Cash App.

- Tap the profile icon in the upper-right corner.

- Select “Linked Banks.”

- Tap “Link Bank” and follow the on-screen instructions to add your bank account. You’ll likely need your bank account number and routing number.

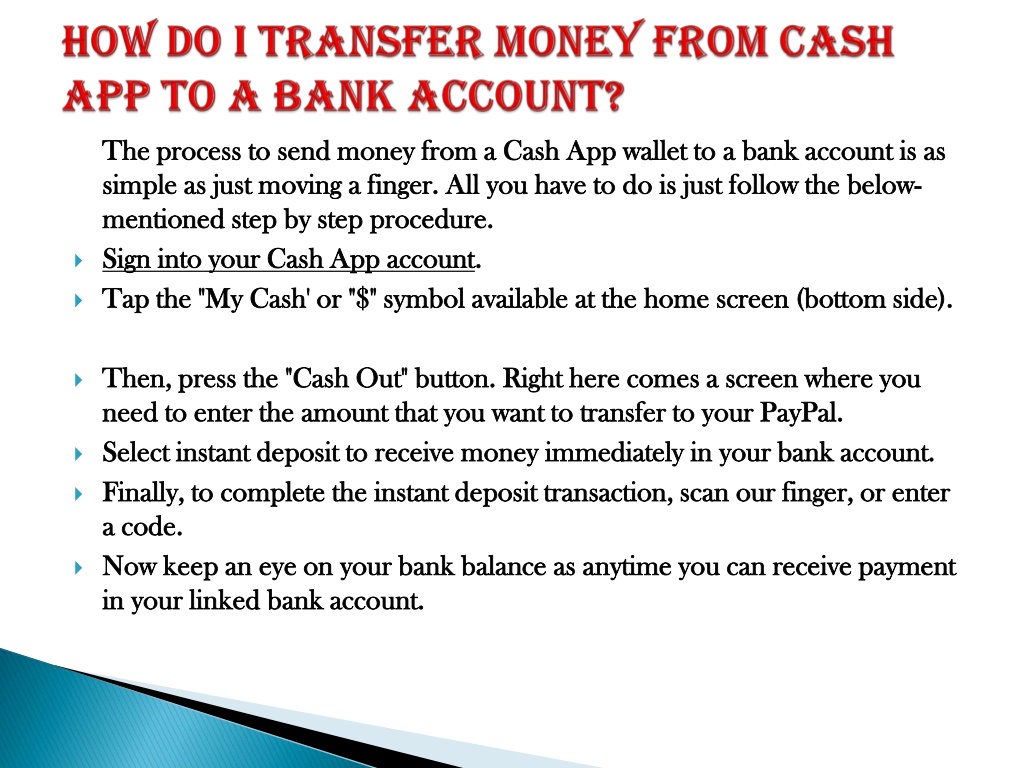

- **Transfer Funds from Cash App to Your Bank Account:**

- From the Cash App home screen, tap the “Money” tab (the dollar sign icon).

- Tap “Cash Out.”

- Enter the amount you want to transfer.

- Choose between “Standard” (free, usually takes 1-3 business days) or “Instant” (fee applies, usually immediate) transfer.

- Confirm the transfer to your linked bank account.

- **Add the Same Bank Account to PayPal:**

- Log in to your PayPal account on a web browser (the app may have limited functionality).

- Click on “Wallet” or “Linked Accounts.”

- Select “Link a bank account.”

- Enter your bank account information (account number and routing number). PayPal may require you to confirm the account by verifying small deposits.

- **Transfer Funds from Your Bank Account to PayPal:**

- From your PayPal “Wallet,” click “Transfer Money.”

- Select “Add money to your balance.”

- Choose the linked bank account.

- Enter the amount you want to transfer and confirm the transaction.

This method, while slightly time-consuming, is generally the safest and most straightforward way to move funds between Cash App and PayPal. Be aware of potential transfer limits and fees associated with each platform and your bank.

Workaround 2: Using a Debit Card as an Intermediary

Another method involves using a debit card linked to both Cash App and PayPal. This approach can be faster than using a bank account, but it may also incur fees.

- **Link Your Debit Card to Cash App:** If you haven’t already, link your debit card to your Cash App account. This is usually done during the initial setup, but you can add additional cards in the “Linked Banks” section of your profile.

- **Transfer Funds from Cash App to Your Debit Card:** Use the “Cash Out” feature in Cash App to transfer funds to your linked debit card. Choose the “Instant” transfer option for faster processing, but be aware of the associated fees.

- **Link the Same Debit Card to PayPal:** Add the same debit card to your PayPal account in the “Wallet” section.

- **Transfer Funds from Your Debit Card to PayPal:** Use the “Add money” feature in PayPal to transfer funds from your linked debit card to your PayPal balance.

This method is faster than using a bank account, but it’s essential to be mindful of potential fees charged by both Cash App and PayPal for debit card transfers. These fees can vary, so it’s a good idea to check the fee structure before initiating the transfer.

Workaround 3: Using a Payment App That Connects To Both

While a direct transfer is impossible, some third-party payment apps can act as a bridge between Cash App and PayPal, although this is rare and often involves more steps. Check for apps that allow funding from Cash App and then sending to PayPal (or vice versa). Be wary of these apps and always do extensive research to ensure they are reputable and secure.

Detailed Feature Analysis: Cash App and PayPal

To better understand why direct transfers aren’t possible, let’s delve into the features of each platform.

Cash App:

* **Peer-to-Peer Payments:** Cash App excels at quick and easy peer-to-peer payments. Users can send and receive money instantly using their Cash App balance or linked debit card.

* **Cash Card:** The Cash Card is a Visa debit card linked to your Cash App balance. It allows you to spend your Cash App funds at any merchant that accepts Visa.

* **Bitcoin and Stock Investing:** Cash App allows users to buy and sell Bitcoin and invest in stocks directly from the app. This feature makes it a popular choice for those interested in cryptocurrency and investment.

* **Direct Deposit:** Users can set up direct deposit to receive their paychecks directly into their Cash App account. This feature makes Cash App a viable alternative to a traditional bank account for some users.

* **Cash Boosts:** Cash Boosts are discounts and rewards offered to Cash App users. These boosts can be applied to purchases made with the Cash Card, providing savings on everyday expenses.

PayPal:

* **Global Payments:** PayPal is widely accepted globally, making it a convenient option for international transactions.

* **Buyer Protection:** PayPal offers buyer protection, which can help users get their money back if they encounter problems with a purchase.

* **Seller Tools:** PayPal provides a range of tools for businesses, including invoicing, payment processing, and reporting.

* **Credit and Debit Card Processing:** PayPal allows businesses to accept credit and debit card payments online and in person.

* **PayPal Credit:** PayPal offers a line of credit that can be used to make purchases online and pay them off over time.

Advantages, Benefits, and Real-World Value

While transferring between Cash App and PayPal directly isn’t possible, understanding the workarounds provides significant value. Users can leverage the strengths of each platform, such as Cash App’s ease of peer-to-peer payments and PayPal’s global acceptance.

* **Flexibility:** Using a bank account as an intermediary allows users to move funds between platforms as needed, providing flexibility in managing their finances.

* **Access to Different Features:** By using both Cash App and PayPal, users can access a wider range of features and services, such as Cash App’s Bitcoin investing and PayPal’s buyer protection.

* **Convenience:** While not direct, the workarounds are relatively convenient, especially for users who already have bank accounts or debit cards linked to both platforms.

* **Avoiding Fees:** By choosing standard transfer options, users can avoid fees associated with instant transfers, saving money on their transactions.

Comprehensive Review of Both Platforms

Both Cash App and PayPal have their strengths and weaknesses. Here’s a detailed review:

Cash App:

* **User Experience & Usability:** Cash App is known for its simple and intuitive interface. Sending and receiving money is quick and easy.

* **Performance & Effectiveness:** Cash App performs well for peer-to-peer payments and basic financial transactions. However, it may not be suitable for complex business transactions.

* **Pros:**

* Easy to use

* Fast peer-to-peer payments

* Bitcoin and stock investing

* Cash Card with boosts

* Direct deposit

* **Cons:**

* Limited international support

* Fewer seller tools compared to PayPal

* Potential security risks if not used carefully

* Instant transfer fees

* **Ideal User Profile:** Individuals who need to send and receive money quickly and easily, and who are interested in Bitcoin and stock investing.

* **Alternatives:** Venmo, Zelle

PayPal:

* **User Experience & Usability:** PayPal has a more complex interface than Cash App, but it offers a wider range of features.

* **Performance & Effectiveness:** PayPal is highly effective for online payments, business transactions, and international transfers.

* **Pros:**

* Widely accepted globally

* Buyer protection

* Seller tools

* Credit and debit card processing

* PayPal Credit

* **Cons:**

* More complex interface

* Higher fees for some transactions

* Account holds and freezes can be problematic

* Customer service can be slow

* **Ideal User Profile:** Businesses and individuals who need to make and receive payments online, especially for international transactions.

* **Alternatives:** Stripe, Square

**Expert Overall Verdict & Recommendation:** Both Cash App and PayPal are valuable tools for managing finances. Cash App is best for simple peer-to-peer payments and basic investing, while PayPal is better suited for online business transactions and international transfers. Understanding the workarounds for transferring funds between them allows users to leverage the strengths of both platforms.

Insightful Q&A Section

Here are some frequently asked questions about transferring money between Cash App and PayPal:

- **Question:** What are the fees associated with transferring money from Cash App to PayPal using a bank account?

**Answer:** Cash App typically doesn’t charge fees for standard transfers to a bank account, but your bank might have its own fees. PayPal also generally doesn’t charge fees for adding money from a bank account. Always check the fee structures of both platforms and your bank before initiating a transfer. - **Question:** How long does it take to transfer money from Cash App to PayPal using a bank account?

**Answer:** Standard transfers from Cash App to a bank account usually take 1-3 business days. Adding money from a bank account to PayPal typically takes the same amount of time. - **Question:** Is it possible to transfer money from Cash App to PayPal instantly?

**Answer:** While Cash App offers instant transfers to a debit card for a fee, the overall process of transferring to PayPal will still be limited by the time it takes PayPal to receive funds from the debit card or bank account. - **Question:** What are the transfer limits for Cash App and PayPal?

**Answer:** Cash App has sending and receiving limits that vary depending on whether your account is verified. PayPal also has limits that depend on your account status. Check the specific limits on each platform’s website or app. - **Question:** Can I use a prepaid card to transfer money from Cash App to PayPal?

**Answer:** Generally, prepaid cards can be linked to Cash App and PayPal, but there may be limitations or restrictions. Check with the specific prepaid card issuer and both platforms to confirm compatibility. - **Question:** What security measures should I take when transferring money between Cash App and PayPal?

**Answer:** Always use strong passwords, enable two-factor authentication, and be cautious of phishing scams. Monitor your account activity regularly and report any suspicious transactions immediately. - **Question:** What happens if a transfer fails between Cash App and PayPal?

**Answer:** If a transfer fails, check your account balances, linked bank accounts, and debit card information. Contact customer support for both platforms if you need further assistance. - **Question:** Are there any tax implications when transferring money between Cash App and PayPal?

**Answer:** Generally, transferring money between accounts is not a taxable event unless it’s considered income (e.g., payment for goods or services). Consult a tax professional for specific advice. - **Question:** Can I use Cash App to send money to someone’s PayPal account directly using their email address?

**Answer:** No, Cash App cannot directly send money to a PayPal account using an email address. You need to use one of the workarounds mentioned above. - **Question:** What is the best method for transferring large sums of money between Cash App and PayPal?

**Answer:** Using a bank account is generally the best method for transferring large sums of money, as it typically has higher transfer limits and lower fees compared to debit card transfers.

Conclusion & Strategic Call to Action

While a direct transfer from Cash App to PayPal isn’t possible, the workarounds discussed provide viable solutions for moving your money between these platforms. By understanding the limitations and utilizing a bank account or debit card as an intermediary, you can effectively manage your funds across both ecosystems. Remember to be mindful of potential fees, transfer limits, and security measures.

As digital payment platforms continue to evolve, it’s essential to stay informed about the best practices for managing your finances. Share your experiences with transferring money between Cash App and PayPal in the comments below. Explore our advanced guide to optimizing your digital payment strategy for more insights and tips. If you have complex financial needs, consider contacting our experts for a consultation on optimizing your payment workflows.